Espp Limits 2025. What to see and do. You may have already decided to invest in yours, but you’re not sure how much money you should be contributing.

You may have already decided to invest in yours, but you’re not sure how much money you should be contributing. The elective deferral limit for employees who participate in 401 (k),.

Is an Employee Stock Purchase Plan (ESPP) better than a Retirement, Where to eat and drink. Each offering has two purchase dates:

ESPP explained in layman's terms (employee stock purchase plan) HRNasty, The irs imposes a limit on the amount of stock an employee can purchase through an espp. We’ll provide more examples later in this article that will illustrate how much money can be made by utilizing an espp properly.

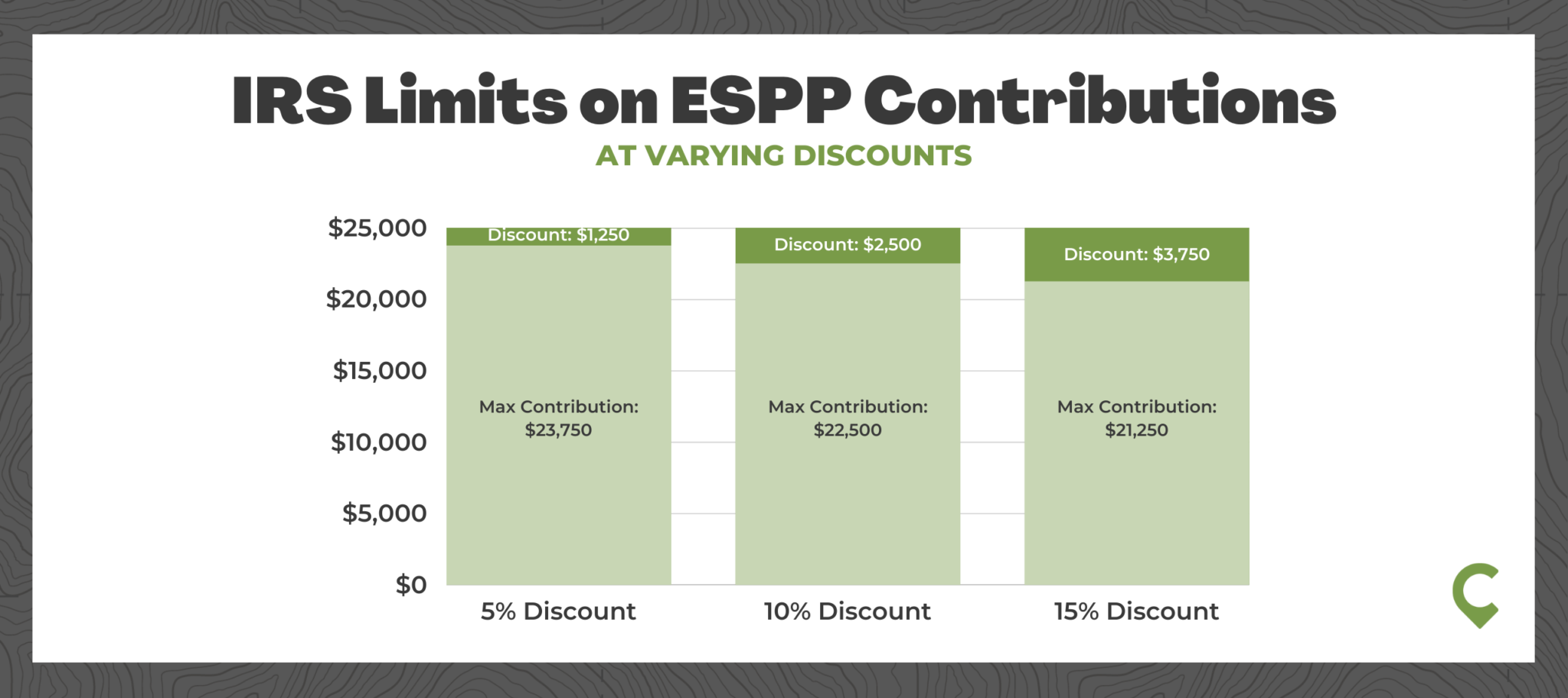

Employee Stock Purchase Plan (ESPP) — Modern Financial Planning, The irs established an annual limit of $25,000 on the amount of company stock an employee can purchase at a discount through an espp. The irs imposes a limit on the amount of stock an employee can purchase through an espp.

Off Limits (1988), Employees will be able to sock away more money into their 401 (k)s next year. To help you make the most of this opportunity, we’ve put together a.

Gdc 2025 Guideline Value Dacie Kikelia, The section 423 $25,000 limit that applies to espps sounds simple enough, but in practice, this limit can be more complicated than it first appears. The resulting dollar limits are.

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, What to see and do. Company allows contributions up to limit of $25,000 per year.

The Minimal Investor ESPP Guide and Calculator Minafi, Tax rules cap the amount of company stock an employee can accrue in an espp at $25,000 of the fair market value of the stock per year. Starting in 2025, employees can contribute up to $23,000 into.

ESPP The Five Things You Need to Know Cordant, The discount allowed is normally 15% of the. You may have already decided to invest in yours, but you’re not sure how much money you should be contributing.

MediCal Limits 2025 Family Of 3 Halli Kerstin, 2025 irs retirement plan limits announced. If you work at microsoft, you may be eligible to enroll in the employee stock purchase plan (espp).

Roth Contribution Limits 2025 Caril Cortney, The irs established an annual limit of $25,000 on the amount of company stock an employee can purchase at a discount through an espp. This limit is commonly referred to as the section 423 (b) limit or.